Are VAT details mandatory in billing?

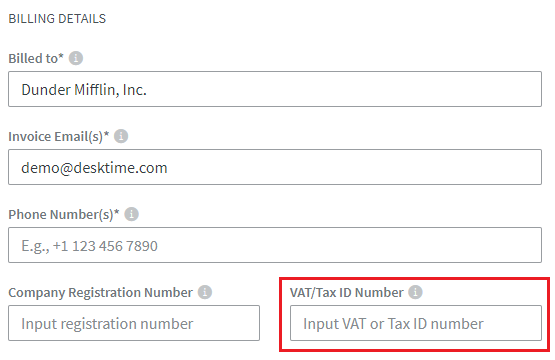

When setting up your payment method for a DeskTime subscription, you will be asked to fill out the details about your company, one of them being a VAT/Tax ID number.

The importance of the VAT/Tax ID number depends on what country your company is based in:

- If you are a European taxpayer company and have added the VAT/Tax ID in the billing section, the tax will not be applied to your subscription.

- If you are a European taxpayer company and VAT/Tax ID has not been added in the billing section, the tax will be applied to your subscription. The VAT amount will be according to your country's official tax rates.

- If your company is located outside of Europe, the tax will not be applied to your subscription.

- If your company is located in Latvia, the tax will always be applied, regardless of whether a VAT number has been specified or not.

If you have any questions about Tax details for your company, please reach out to the support team for assistance.